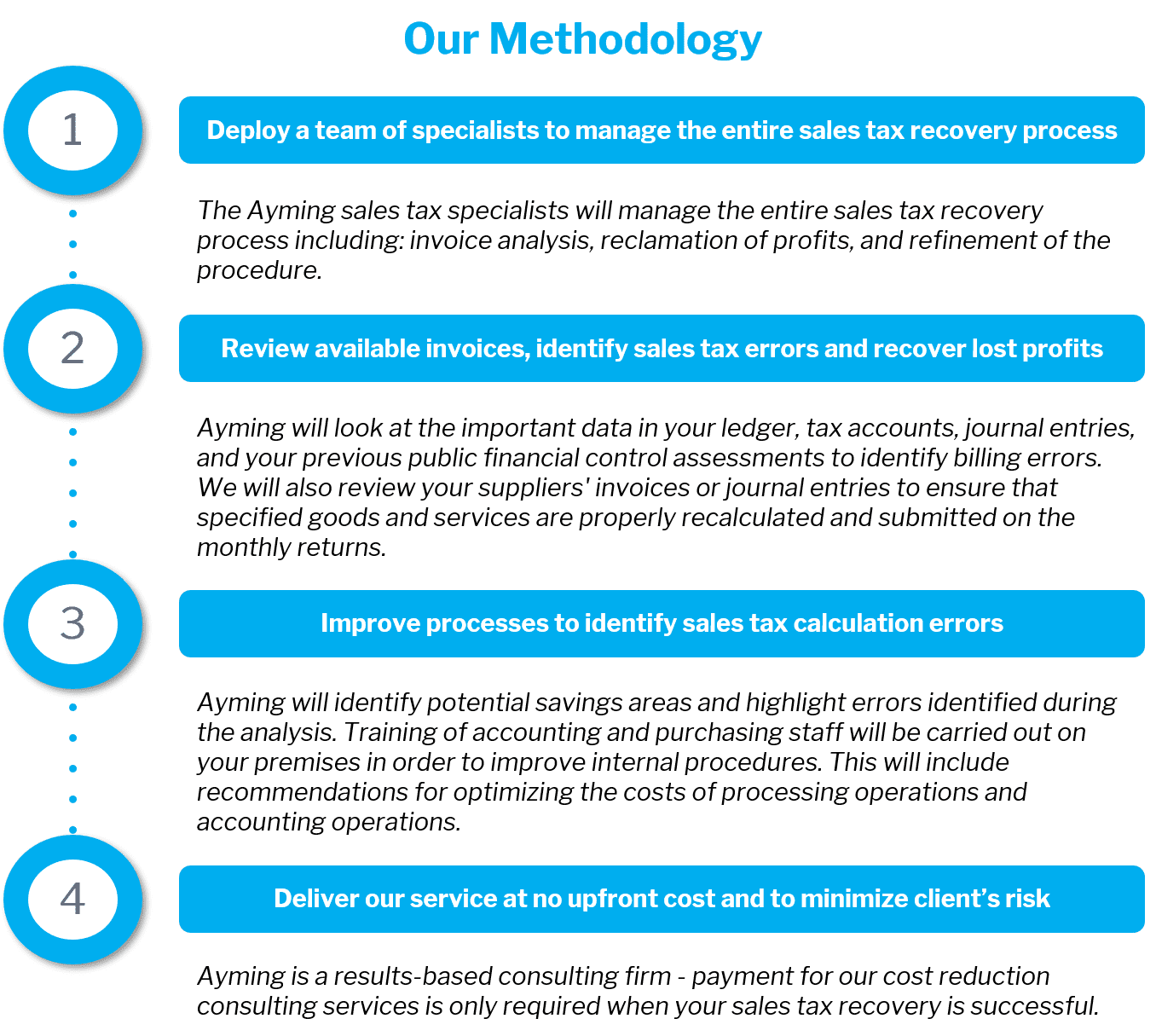

Ayming can help you recover lost profits by identifying tax recovery opportunities and ensuring that you are maximizing those dollars with our industry knowledge, expertise, and proprietary tools. These savings could finance part of your future investments and your development long term.

Sales Tax Recovery

Many companies may not be aware they are overpaying sales tax, which could be costing them large sums of unnecessary expenditures. Sales tax percentage errors in sales and use taxes can be recovered retroactively up to 4 years in some states, and Ayming can help with the process.

An independent review of sales tax expenses and procedures isolates areas where sales tax was paid unnecessarily, helping you to recover lost profits. This review will identify where errors are produced through the analysis of overpayment caused by automating procedures, the different levels of human intervention, the number of suppliers, and/or the complexity of operations. Without regular monitoring and awareness of when and how overpayment can occur, margins of error remain present and create often erroneous sales tax catches. These types of mistakes are unfortunately common and lead to an undeniable loss of profit.

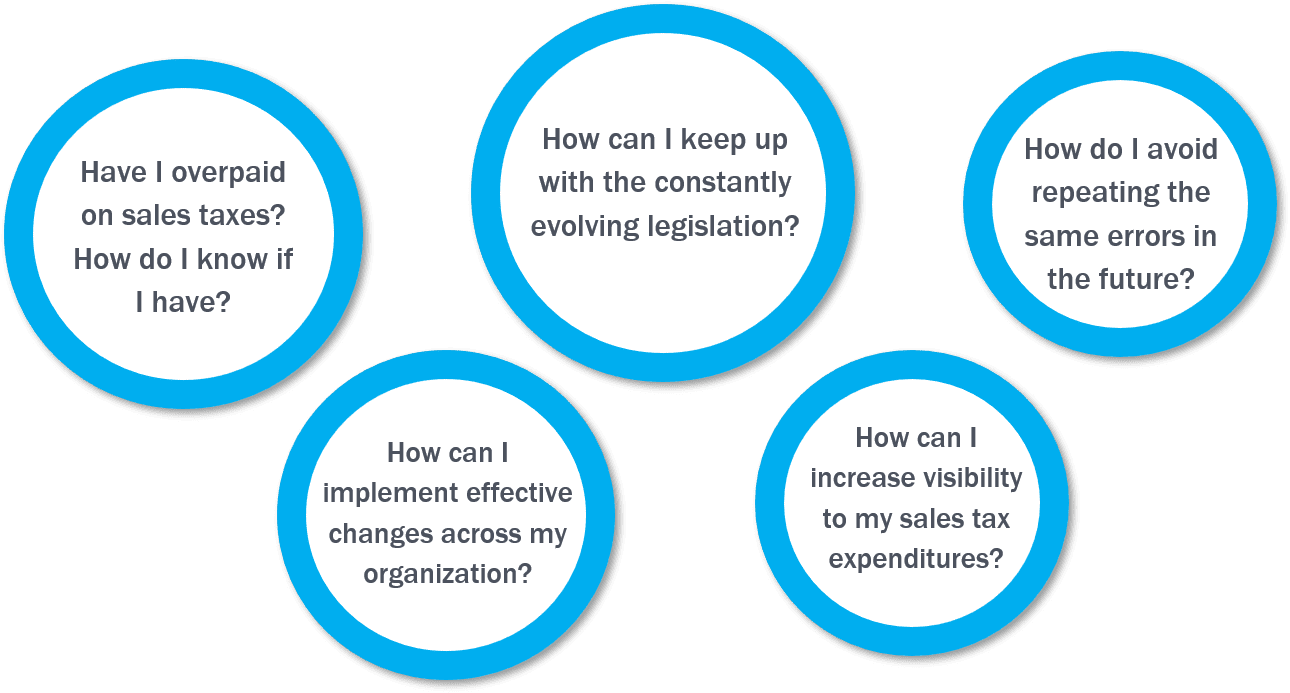

Common Industry Challenges

Companies conducting high volumes of transactions involving multiple vendors can easily overlook substantial disbursements which over time can have an impact on the bottom line. Without regular monitoring and increased awareness of where and how over payment can occur, the combination of these elements creates room for further inaccurate tax capturing leading to frequent errors and ultimately, lost profits. When considering Sales Tax Recovery options, many companies are faced with the following questions: