Our experts provide their thoughts and opinions on the trends and developments impacting our clients.

Our latest thinking

R&D Tax Credits Should Be Part of Biotech’s DNA

Due to the need for constant product and process developments, the cost of R&D for the biotech industry is…

More

Why are software companies investing their own capital into R&D initiatives, but not claiming, or drastically under claiming, the established…

From Beta to Data: Why Software Companies Should Claim the R&D Tax Credit Throughout the Development Lifecycle

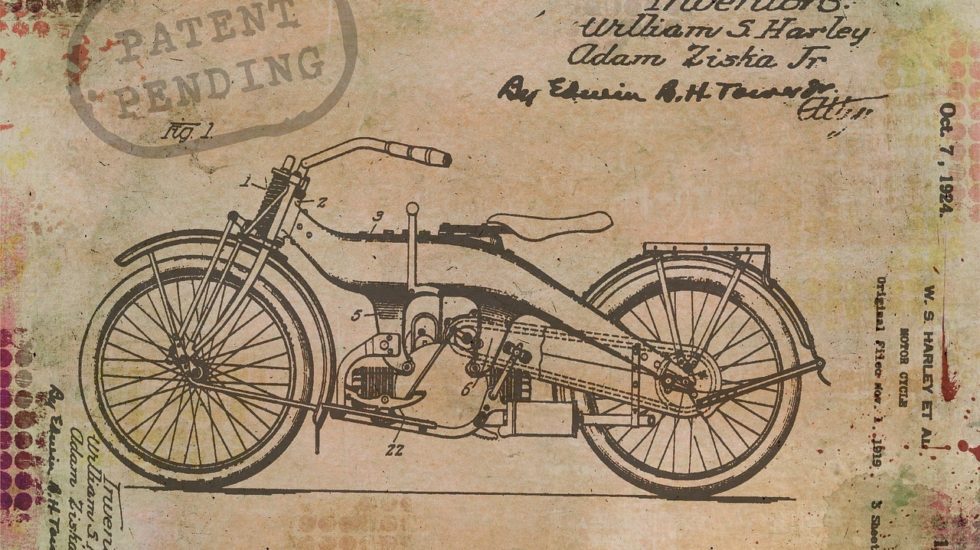

If a company’s patent application is accepted, the IRS considers that the project meets the 3 key qualifying criteria for…

All Companies Holding Patents Are Eligible for R&D Tax Credits

North America spends more on MRO than any other region and is forecasted to do so throughout the next ten…

Sky High Costs: Not Optimizing Aerospace MRO Expenditures Can Make Profits Crash

R&D tax credits can help aviation maintenance take flight. While many companies are already performing eligible activities, identifying and documenting…

R&D Tax Credits: What the Aviation Maintenance Industry Should Know

While many in the plant growing industry turn to financial institutions or private investors as potential sources of funding, there…

Growing Concern: Plant Industry May Not Be Claiming R&D Tax Credits, But It Should

What is the R&D Tax Credit ? The R&D Tax Credit helps companies remain competitive by allowing a reduction of…

Latest Changes to R&D Tax Credits Eliminate the AMT

What’s in Store for Retailers When It Comes to R&D Tax Credits?

There is a misconception when it comes to R&D that it only applies to activities conducted in a lab. For…

More

It is estimated that indirect expenditures represent up to 20% of a company’s total spend, presenting an opportunity for significant…

Transforming Indirect Procurement into Profits

To remain competitive, companies must evolve. This is true of any company, including those belonging to the agri-food sector.…

Feeding Agri-Food Growth Through the R&D Tax Credit

While there are benefits to maintaining a physical retail presence, there are also high costs associated with operating stores. Overhead…

Retail: The Direct Impact of Indirect Costs

For many large businesses, claiming the R&D tax credit provides significant funding that can be re-injected into the continuous improvement…

Audit Exemptions and Reduced Tax Rates Are Making R&D Tax Credits Even More Appealing

“Reducing costs is not just a purchasing function. Finance, HR, production, marketing, and all other departments must optimize their processes…

Ayming Ranks #1 in Capital Magazine Among Top Management Consulting Firms for Overall Cost Optimization and Procurement

For many large businesses, claiming the R&D tax credit provides significant funding that can be re-injected into the continuous improvement…

How Procurement Levers Can Help Start-Ups Survive the Dragon’s Den