International Innovation Barometer 2025

Innovation is not just a buzzword; it’s the driving force behind the rapid technological advancements shaping our world today. In…

Download

The outlook for innovation is promising Research and Development (R&D) spending is on the rise across the globe. In an…

International Innovation Barometer 2020

It’s about time architecture and engineering firms took a break – a tax break that is. Despite the broad range…

R&D Tax Credits Can Help Architecture and Engineering Firms Develop A Blueprint for Growth

Due to the need for constant product and process developments, the cost of R&D for the biotech industry is…

R&D Tax Credits Should Be Part of Biotech’s DNA

Why are software companies investing their own capital into R&D initiatives, but not claiming, or drastically under claiming, the established…

From Beta to Data: Why Software Companies Should Claim the R&D Tax Credit Throughout the Development Lifecycle

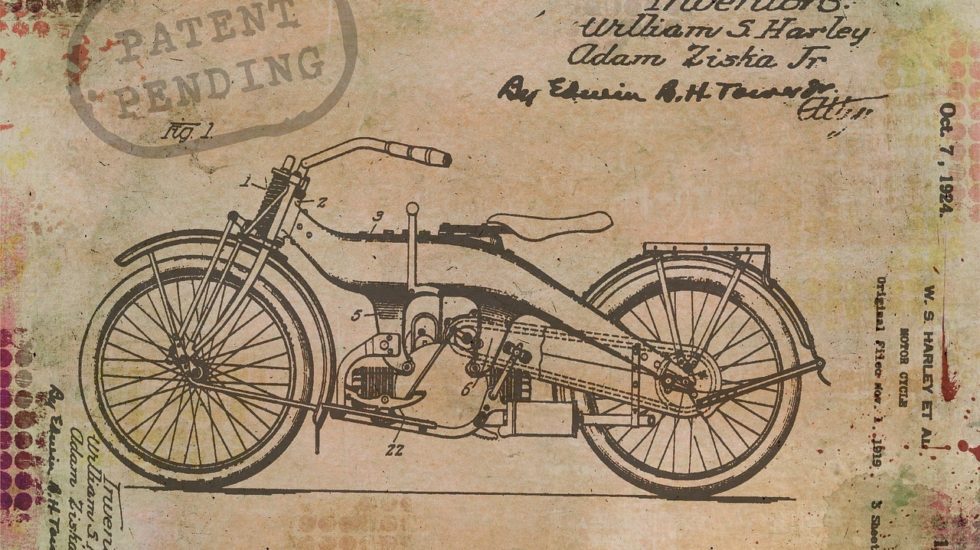

If a company’s patent application is accepted, the IRS considers that the project meets the 3 key qualifying criteria for…

All Companies Holding Patents Are Eligible for R&D Tax Credits

R&D tax credits can help aviation maintenance take flight. While many companies are already performing eligible activities, identifying and documenting…

R&D Tax Credits: What the Aviation Maintenance Industry Should Know

Latest Changes to R&D Tax Credits Eliminate the AMT

What is the R&D Tax Credit ? The R&D Tax Credit helps companies remain competitive by allowing a reduction of…

More

There is a misconception when it comes to R&D that it only applies to activities conducted in a lab. For…

What’s in Store for Retailers When It Comes to R&D Tax Credits?

To remain competitive, companies must evolve. This is true of any company, including those belonging to the agri-food sector.…

Feeding Agri-Food Growth Through the R&D Tax Credit

1. Most funding programs do not cover past expenses The vast majority of government funding programs, other than tax credits,…

The top 3 things you may not know about government incentives

The U.S. R&D Tax Credit helps companies remain competitive by allowing a reduction of federal and state income taxes owed…

U.S. R&D tax credit changes drive innovation, create new opportunities for American business